Buy Now, Pay Later (BNPL) services have transformed how people shop online by allowing customers to split purchases into smaller, interest-free payments. Instead of paying the full amount upfront, shoppers can divide costs over weeks or months, making everything from fashion to electronics more affordable. As eCommerce continues to grow, BNPL platforms are becoming a preferred payment option for budget-conscious consumers who want flexibility without relying on traditional credit cards.

Today’s BNPL platforms offer seamless checkout integration, fast approval processes, and transparent repayment schedules. Many also provide mobile apps that help users track spending and manage upcoming payments. For online shoppers, BNPL means greater purchasing power and improved cash flow management. For retailers, it means higher conversion rates and reduced cart abandonment.

However, not all BNPL platforms are created equal. Fees, repayment terms, merchant coverage, and credit checks vary significantly. Choosing the right BNPL provider can help shoppers avoid unnecessary charges while enjoying safe and flexible shopping.

In this guide, Savings24x7 will explore the Top 10 Buy Now, Pay Later platforms for online shoppers, highlighting their features, suitability, and value. We also compare them side by side to help you decide which service best fits your shopping habits.

Best Buy Now, Pay Later Platforms for Online Shoppers

BNPL platforms differ in repayment length, interest charges, supported retailers, and user experience. The following list includes the most trusted and widely used BNPL services globally, offering flexibility for everyday purchases and larger investments.

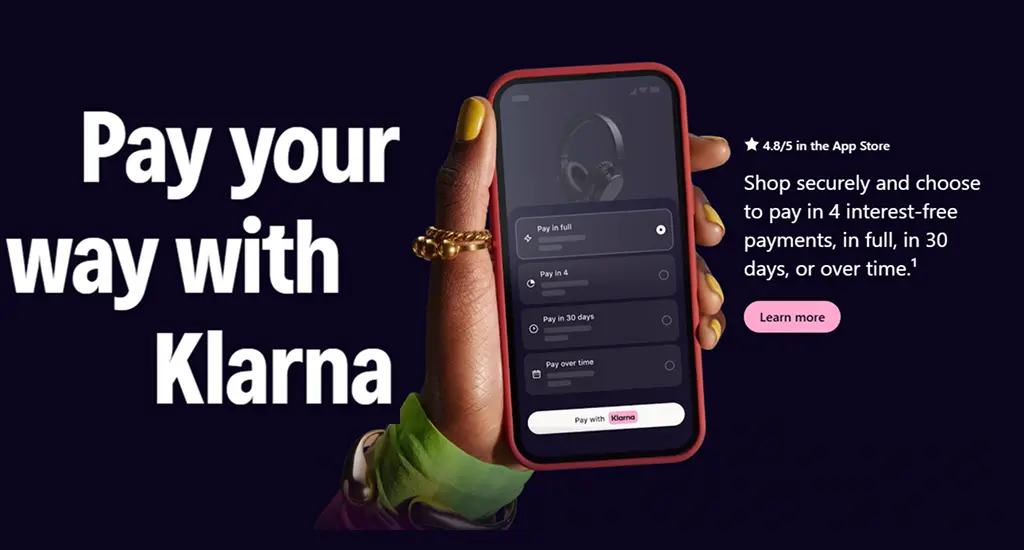

1. Klarna

Klarna is one of the most widely used Buy Now, Pay Later platforms in the world, serving millions of users across Europe, the United States, and Australia. It offers multiple payment options, including Pay in 4 installments, Pay in 30 days, and long-term financing for higher-value purchases. This flexibility makes Klarna suitable for everyday shopping as well as big-ticket items such as furniture, electronics, and travel.

For shoppers, Klarna provides a smooth checkout experience and a feature-rich mobile app that allows users to track orders, manage payment schedules, and receive reminders before due dates. Klarna performs soft credit checks for most short-term plans, meaning it usually does not affect a customer’s credit score. Customers can also pause or reschedule payments in some regions, giving added flexibility.

For merchants, Klarna integrates easily with major eCommerce platforms such as Shopify, WooCommerce, Magento, and BigCommerce. Retailers receive payment upfront while Klarna manages fraud prevention, customer payments, and credit risk. Businesses using Klarna often report higher conversion rates and increased average order values because customers feel more confident making purchases when installment options are available.

Klarna partners with thousands of brands including IKEA, Nike, Sephora, and ASOS. Shoppers can save money through Klarna-exclusive discounts, promotional financing offers, and interest-free plans. Merchants benefit from increased exposure through Klarna’s shopping app, which allows users to browse participating stores.

Klarna is ideal for both global retailers and online shoppers looking for flexible BNPL payment options with strong brand trust and wide merchant coverage.

2. Afterpay

Afterpay is a popular BNPL platform focused on short-term, interest-free installment payments. Customers divide their purchase into four equal payments over six weeks, with the first payment due at checkout. This simplicity makes Afterpay especially appealing to younger consumers and fashion-focused shoppers.

For users, Afterpay is easy to understand and does not charge interest if payments are made on time. The app allows customers to track spending, view upcoming payments, and discover partner merchants. Approval is fast and usually does not require a hard credit check, making it accessible to shoppers with limited credit history.

For merchants, Afterpay integrates with major eCommerce platforms and point-of-sale systems. Businesses benefit from increased sales, particularly in fashion, beauty, and lifestyle categories. Afterpay reports higher basket sizes and repeat purchases from customers who use installment payments. Merchants receive full payment upfront, while Afterpay manages collections and customer repayments.

Afterpay partners with thousands of retailers such as Adidas, H&M, Urban Outfitters, and Forever 21. Shoppers can save money by taking advantage of Afterpay-exclusive discounts and promotional campaigns offered through the app. Retailers can also participate in Afterpay’s marketing events and shopping days to drive traffic and boost visibility.

Afterpay works best for businesses offering affordable consumer goods and for shoppers who prefer short repayment cycles without interest or complex loan terms.

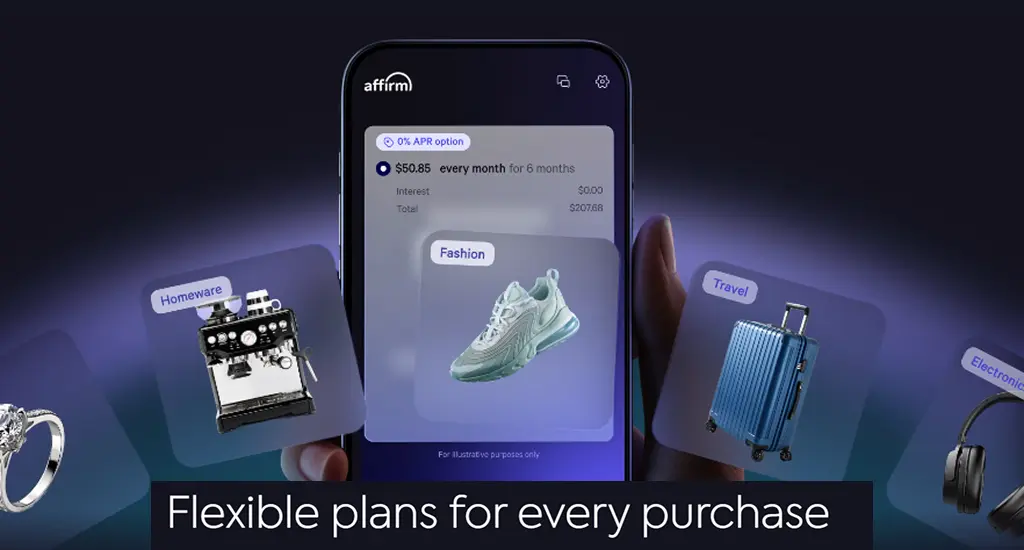

3. Affirm

Affirm is a leading BNPL provider that specializes in transparent, long-term installment financing. Unlike many short-term BNPL services, Affirm allows customers to spread payments over 3, 6, or 12 months and sometimes longer. It clearly displays the total cost, including interest, before purchase, ensuring there are no hidden fees.

For shoppers, Affirm is ideal for higher-priced purchases such as electronics, fitness equipment, travel, and furniture. Some plans are interest-free, while others carry low APR depending on the user’s credit profile. Affirm does not charge late fees in most regions, reducing financial stress for customers.

For merchants, Affirm integrates with major platforms including Shopify, BigCommerce, and custom APIs. It helps businesses sell high-ticket items by reducing price resistance at checkout. Retailers receive payment upfront, while Affirm assumes the credit risk and handles customer repayment.

Affirm partners with major brands such as Amazon, Walmart, Peloton, and Best Buy. Shoppers can save money by choosing zero-interest promotional plans and comparing financing options within the Affirm checkout interface. Merchants benefit from detailed analytics and marketing tools to target customers seeking financing solutions.

Affirm is best suited for merchants selling expensive products and shoppers who want longer repayment periods with full transparency and no surprise charges.

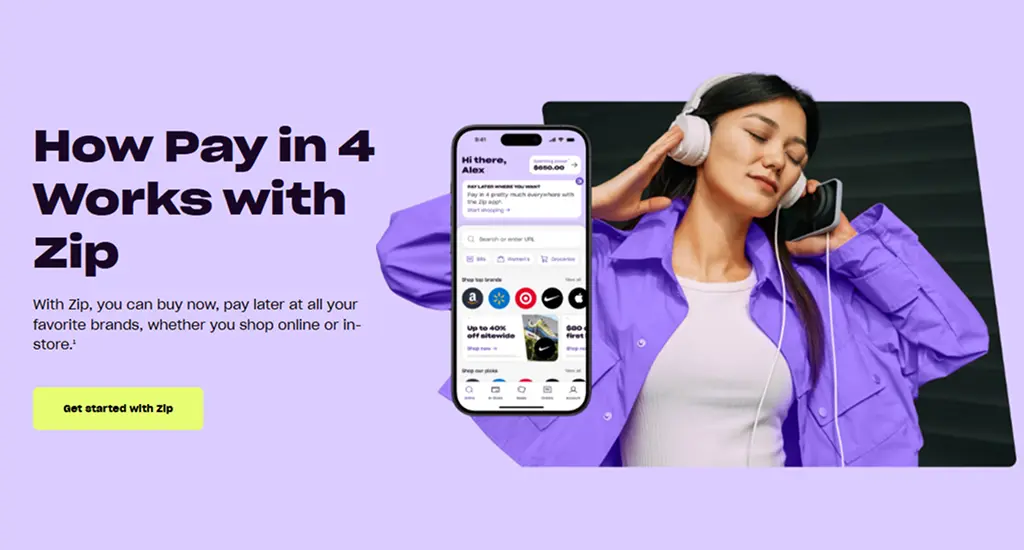

4. Zip (Quadpay)

Zip is a BNPL platform that allows customers to split purchases into four interest-free payments over six weeks. It is widely used for fashion, beauty, and everyday retail purchases. Zip provides a user-friendly mobile app that enables customers to manage payments, receive notifications, and browse participating retailers.

For shoppers, Zip offers fast approval with minimal credit requirements. While Zip does not charge interest, it may apply small service fees depending on the region. All fees and payment schedules are shown clearly before checkout, ensuring transparency. Zip helps shoppers manage short-term budgets without using traditional credit cards.

For merchants, Zip integrates with most major eCommerce platforms and point-of-sale systems. Retailers receive full payment immediately while Zip handles repayment collection and fraud risk. This allows businesses to increase sales without worrying about customer default. Zip also provides reporting tools and marketing support for partner merchants.

Zip partners with well-known retailers such as Macy’s, Target, and various fashion and lifestyle brands. Shoppers can save money by using Zip at merchants that offer Zip-only discounts or waive service fees. Retailers benefit from higher conversion rates and increased customer loyalty.

Zip is best suited for businesses targeting everyday shoppers and customers who want simple BNPL payment options with short repayment cycles.

5. PayPal Pay in 4

PayPal Pay in 4 allows shoppers to divide purchases into four interest-free payments over six weeks using their existing PayPal account. Because PayPal is already trusted by millions of users worldwide, this BNPL option offers strong security and convenience without requiring a separate registration process.

For shoppers, PayPal Pay in 4 provides automatic payment scheduling and easy tracking within the PayPal app. There are no interest charges if payments are made on time, and approval is quick for eligible users. This makes it an attractive choice for customers who already rely on PayPal for online shopping.

For merchants, PayPal Pay in 4 can be enabled through existing PayPal checkout systems with minimal technical changes. Retailers benefit from higher conversion rates and reduced cart abandonment while PayPal manages fraud protection and customer repayment risk.

PayPal Pay in 4 is accepted by thousands of online stores globally. Shoppers can save money by combining this BNPL option with PayPal cashback offers, retailer discounts, and seasonal promotions. Merchants gain access to PayPal’s large user base and trusted payment infrastructure.

PayPal Pay in 4 is ideal for businesses that already use PayPal and for shoppers who want a secure, interest-free BNPL payment option with minimal setup.

6. Sezzle

Sezzle is a Buy Now, Pay Later platform built around responsible spending and financial empowerment. It allows customers to split purchases into four interest-free payments over six weeks, making it easier to manage budgets without relying on credit cards. One of Sezzle’s key strengths is its focus on transparency and consumer education, which makes it popular among younger shoppers and families.

For shoppers, Sezzle provides payment reminders, spending limits, and an easy-to-use mobile app for tracking purchases. A unique feature is Sezzle Up, an optional program that helps users build their credit history by reporting successful repayments to credit bureaus. Customers can also reschedule payments for a small fee if unexpected expenses arise, offering flexibility during tight financial periods.

For merchants, Sezzle integrates seamlessly with major eCommerce platforms such as Shopify, WooCommerce, Magento, and BigCommerce. Retailers receive full payment upfront while Sezzle handles customer repayments and fraud risk. This improves cash flow and reduces administrative work for businesses. Sezzle is especially popular with small and medium-sized brands, including ethical and sustainable retailers.

Sezzle partners with thousands of independent fashion, beauty, and lifestyle brands. Shoppers can save money through interest-free installment plans, exclusive merchant promotions, and Sezzle-hosted sales events. Merchants benefit from higher conversion rates and increased average order values as customers feel more confident completing purchases.

Sezzle is best suited for merchants targeting conscious consumers and for shoppers who want flexible BNPL payment options with financial guidance and long-term credit-building benefits.

7. Splitit

Splitit offers a different approach to Buy Now, Pay Later by allowing customers to pay in installments using their existing credit card limit rather than taking out a new loan. Instead of creating a separate line of credit, Splitit places a temporary authorization hold on the customer’s card and then charges monthly installments without interest.

For shoppers, Splitit is attractive because it does not require a new credit application and typically does not impact credit scores. There are no interest charges, and payments are deducted gradually from the card’s available balance. This makes Splitit appealing to customers who already have sufficient credit limits and want to avoid traditional BNPL loans or third-party accounts.

For merchants, Splitit integrates with high-end retailers, travel companies, and service providers through APIs and popular eCommerce platforms. It enables businesses to sell premium products such as luxury fashion, jewelry, medical services, and travel packages by offering installment flexibility without offering in-house financing. Merchants receive payment authorization upfront and benefit from reduced cart abandonment.

Splitit is commonly used by luxury brands and specialized service providers who want to cater to customers seeking interest-free installments. Shoppers save money by avoiding interest charges and loan fees while maintaining control through their existing credit cards.

Splitit is ideal for businesses selling high-value items and for customers who prefer to manage installment payments responsibly using their own credit facilities.

8. Laybuy

Laybuy is a BNPL platform that allows customers to divide their purchases into six weekly interest-free payments. It is widely used in the UK, Australia, and New Zealand and has built a strong reputation in fashion, lifestyle, and beauty retail markets. Laybuy appeals to shoppers who prefer smaller, more frequent payments rather than monthly installments.

For shoppers, Laybuy provides a clear and predictable repayment schedule. The mobile app helps users track payments, receive reminders, and discover participating retailers. There is no interest charged if payments are made on time, though late fees may apply for missed installments. The approval process is fast and requires minimal personal information.

For merchants, Laybuy integrates easily with major eCommerce platforms and point-of-sale systems. Retailers receive full payment upfront while Laybuy manages customer collections and risk. Businesses benefit from increased conversion rates, higher basket sizes, and repeat customers who prefer weekly payment plans.

Laybuy partners with hundreds of fashion and lifestyle retailers and frequently runs exclusive promotional campaigns. Shoppers can save money by using Laybuy at partner stores offering discounts and seasonal sales. Merchants gain additional visibility through Laybuy’s marketplace and marketing initiatives.

Laybuy is best suited for retailers targeting younger consumers and for shoppers who want short-term, interest-free payment options with manageable weekly installments.

9. Amazon Monthly Payments

Amazon Monthly Payments is Amazon’s built-in Buy Now, Pay Later program that allows eligible customers to split selected purchases into 3 to 12 monthly interest-free payments. It is available on qualifying products such as electronics, appliances, and home equipment, and is offered to approved customers based on account history.

For shoppers, this service provides a convenient way to finance larger purchases directly through Amazon without signing up for a third-party BNPL app. Payments are automatically charged to the customer’s card each month, and all transactions can be tracked within the Amazon account dashboard. There are no interest charges when payments are made on time.

For merchants selling through Amazon, Monthly Payments increases affordability for higher-priced items, which can improve sales volume and customer confidence. Amazon handles all payment processing and risk management, allowing sellers to focus on inventory and fulfillment rather than financing.

Shoppers can save money by combining Amazon Monthly Payments with Prime member discounts, seasonal deals, coupons, and events such as Prime Day and Black Friday. This makes it one of the most cost-effective BNPL payment options for frequent Amazon users.

Amazon Monthly Payments is ideal for loyal Amazon customers and for merchants who want to benefit from Amazon’s built-in financing system without managing repayments themselves.

10. Shop Pay Installments (by Affirm)

Shop Pay Installments is powered by Affirm and integrated directly into Shopify’s checkout system. It allows customers to split purchases into four interest-free payments or choose longer-term financing plans for higher-value items. Because it is built into Shop Pay, the checkout process is fast, secure, and mobile-friendly.

For shoppers, Shop Pay Installments provides clear payment schedules and transparent pricing with no hidden fees. Approval is quick, and customers can manage their payments through the Shop app. Interest-free options are available for many purchases, while longer plans may include low APR financing depending on eligibility.

For merchants, Shop Pay Installments is one of the easiest BNPL solutions to adopt, especially for Shopify store owners. It requires minimal setup and helps increase conversion rates and average order values. Merchants receive payment upfront while Affirm manages repayment and fraud risk.

Shop Pay Installments is widely used by independent brands and direct-to-consumer retailers. Shoppers can save money by selecting interest-free plans and combining installment payments with store promotions and seasonal sales.

This platform is ideal for Shopify-based businesses looking to boost sales and for customers who want flexible BNPL payment options with a smooth and trusted checkout experience.

Comparison Table: Top BNPL Platforms

| Platform | Payment Terms | Interest-Free Option | Best For | Where Available |

|---|---|---|---|---|

| Klarna | 4 weeks to 36 months | Yes | Fashion & general retail | Global |

| Afterpay | 4 payments over 6 weeks | Yes | Fashion & lifestyle | US, UK, AU |

| Affirm | 3–12 months | Sometimes | Large purchases | US, Canada |

| Zip | 4 payments over 6 weeks | Yes | Everyday shopping | US, AU, UK |

| PayPal Pay in 4 | 4 payments over 6 weeks | Yes | PayPal users | Global |

| Sezzle | 4 payments over 6 weeks | Yes | Ethical shopping | US, Canada |

| Splitit | Monthly installments | Yes | Credit card users | Global |

| Laybuy | 6 weekly payments | Yes | Weekly budgets | UK, AU, NZ |

| Amazon Monthly Payments | 3–12 months | Yes | Amazon shoppers | Selected regions |

| Shop Pay Installments | 4 or monthly | Yes | Shopify stores | Global |

Conclusion

Buy Now, Pay Later platforms have become an essential tool for modern online shoppers who want flexibility, affordability, and convenience. Whether purchasing everyday clothing or investing in higher-priced electronics, BNPL services allow customers to spread costs while avoiding heavy interest charges.

Each platform offers unique advantages. Klarna and Afterpay dominate fashion and lifestyle shopping, while Affirm and Amazon Monthly Payments serve customers making larger purchases. PayPal Pay in 4 and Shop Pay Installments integrate seamlessly into existing checkout systems, making them convenient for frequent online buyers. Platforms such as Sezzle and Splitit focus on responsible spending and transparency.

To use BNPL wisely, shoppers should compare repayment terms, avoid late fees, and choose interest-free plans whenever possible. When used responsibly, BNPL platforms can improve budgeting, increase purchasing power, and enhance the overall shopping experience.

By selecting the right BNPL provider based on spending habits and retailer preferences, online shoppers can enjoy greater financial control and smarter purchasing decisions. If you are a frequent flyer, we would love to share our recent article 10 Budget Travel Essentials for Frequent Flyers so that you can make your travel even better.